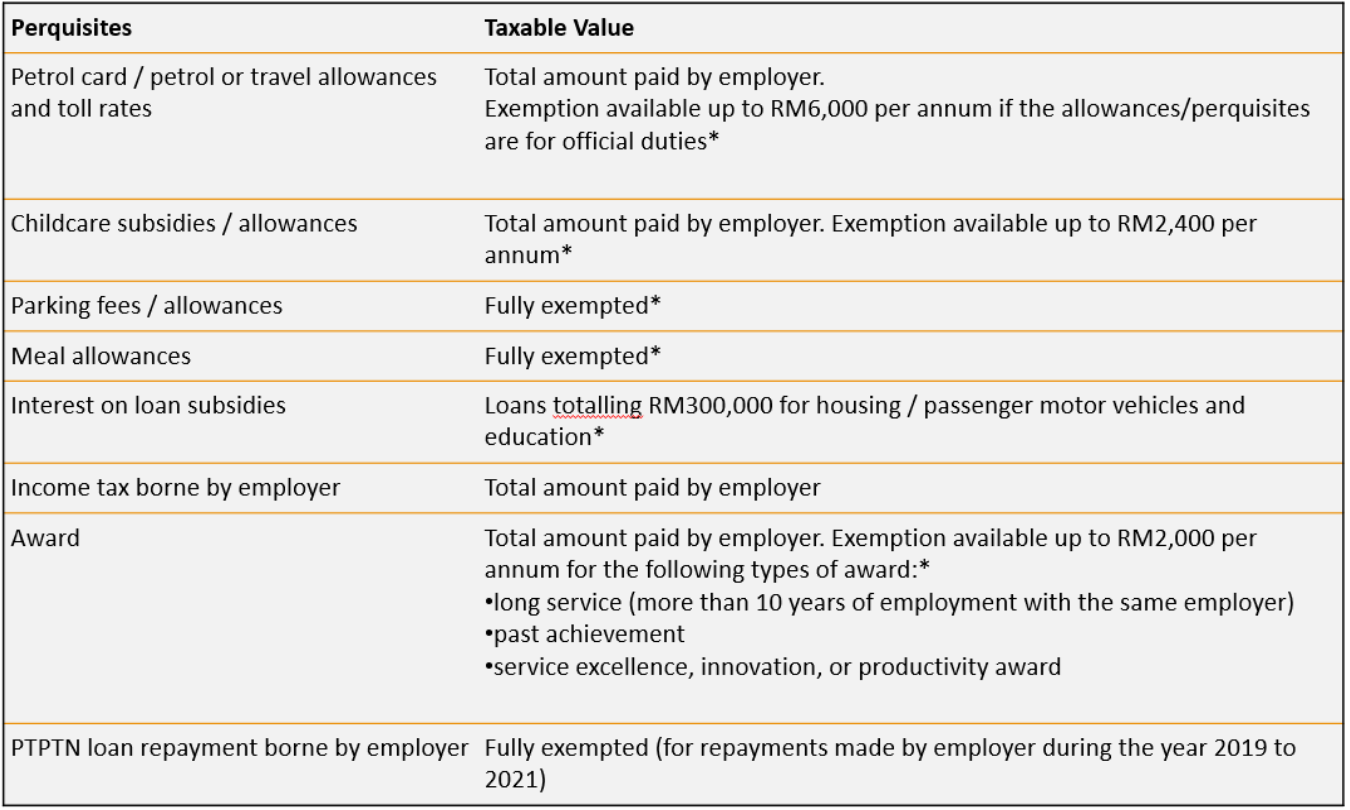

Fixed payment to employees for vacation YES. An allowance can be considered as variable if the same is in the nature of an incentive for additional output beyond the normal output.

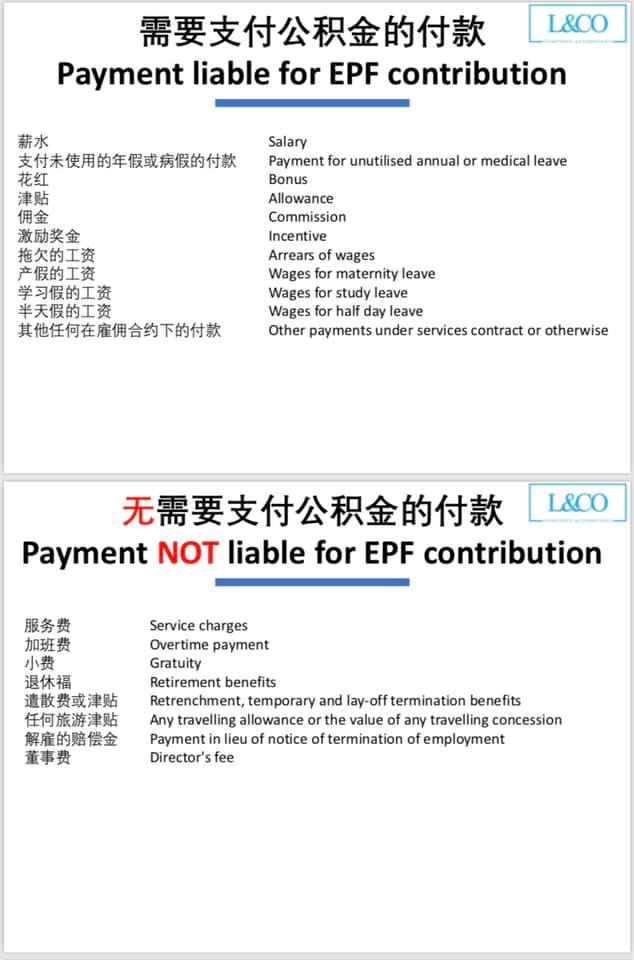

In general all monetary payments that are meant to be wages are subject to EPF contribution.

. EPF deduction in leave bonus and conveyance and laundry allowance is mandatory. In a High Court case the Court held that payments described as reimbursement or travel allowance that were paid by the employer to the employee for trips he made while working as a driver in the company were incentives that are covered under the EPF Act 1991 and were subject to EPF contributions 4. In general all monetary payments that are meant to be wages are subject to EPF contribution.

Employees contribution to statutory provident fund is allowed as deduction us 80c subject to specified conditions. Allowances except a few see below Commissions. Additionally the following list of payments must be included when calculating EPF contributions for employees in Malaysia.

Section 431 EPF Act 1991. 2019 Deloitte Touche Tohmatsu India LLP Provident Fund applicability on allowances 4 Why this discussion Background Supreme Court rules allowances in question are subject to PF Impact on the industry far reaching and significant What we propose to cover What is basic wages under PF Act Judicial history Outcome of the ruling. Allowances not earned by all Employees are not subject to PF contribution.

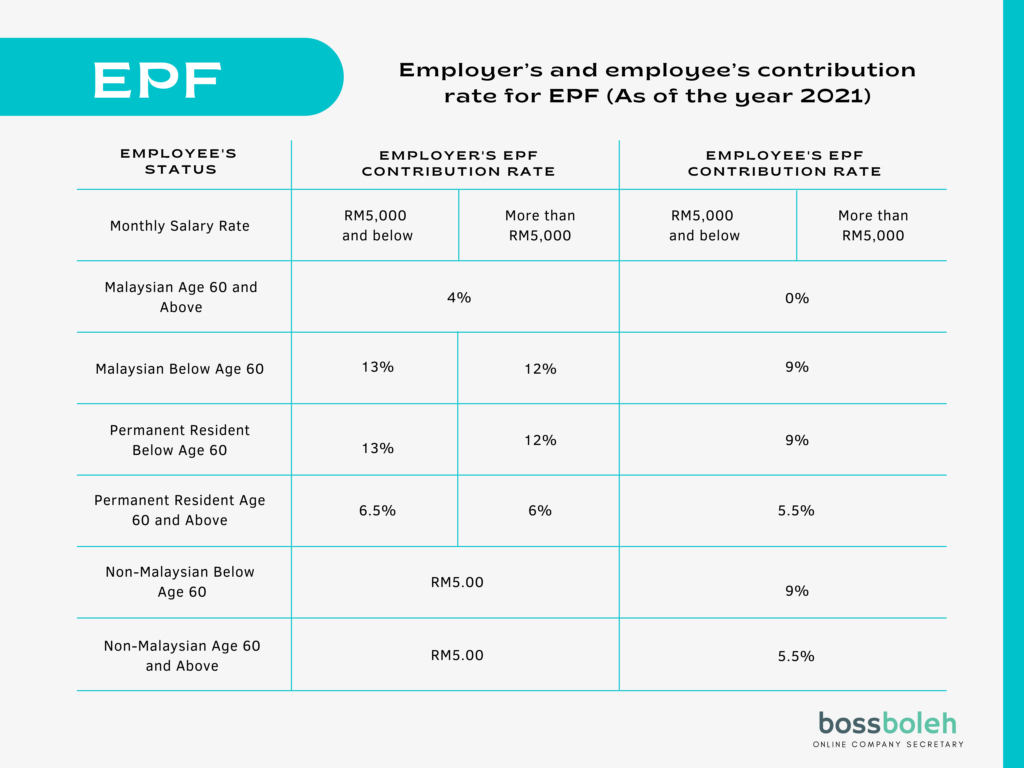

The current rates are 11 for the employee and 12 for the employer but employers are advised to keep abreast with changes which may take place from time to time. However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference. EPF is a great way to get someone other than yourself namely your employer to contribute to your retirement.

For example employee A earns RM6000 per month as their basic salary. Replied by Kap-Chew on topic PetrolFood Allowance is part of EPF Contribution. Employers are legally required to contribute EPF for all payments of wages paid to the employees.

In short yes bonuses and cash allowances are considered to be part of your wages. Other incidental allowances which are related to traveling such as transport allowance outstation allowance food allowance car allowance handphone allowance are subject to EPF contributions UNLESS the said payments are reimbursement in nature. Subject to the provisions of section 52 every employee and every employer of a person who is an employee within the meaning of this Act shall be liable to pay monthly contributions on the amount of wages at the rate respectively set out in the Third Schedule.

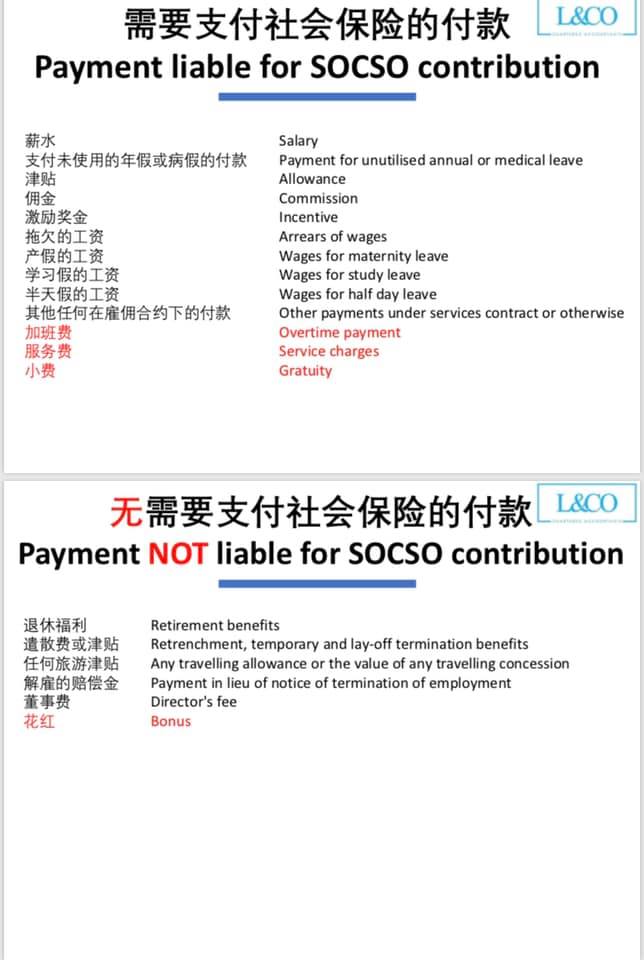

All payments for wages are subject to EPF deductions. Payment in lieu of notice of termination of service payment given when employees service is terminated Directors fee. 5 years 5 months ago 1041.

Here what is the real meaning of Leave Bonus is to be examined from all legal perspective. Updated May 6 2020. Service provider NO Reimbursement for handphone and pager expenses necessarily incurred for official purposes on behalf of employer NO Holiday expenses Is CPF payable.

Any travelling allowance or the value of any travelling concession. Special allowances that form part of Basic wages are subject to PF contributions. Allowance except travelling allowance is included in the definition of wages under the EPF Act.

Payments for unutilized annual or medical leave. Payment of handphone and pager allowances to employees YES Payment of handphone and pager charges directly to third party eg. Membership of the EPF is mandatory for.

Hi Aries For any Variable Pay that you would not want to contribute for Tax SOCSO or EPF just uncheck the. In this situation you may claim deduction in the amount of 6000 500 x 12 months. Other incidental allowances which are related to traveling such as transport allowance outstation allowance food allowance car allowance handphone allowance are subject to EPF contributions UNLESS the said payments are reimbursement in nature.

Your mandatory contribution is calculated based on your monthly salary as an employee in accordance with the Contribution Rate Third Schedule. Dear Colleague Your Question is. The nature of payment of conveyance and laundry allowance is to be.

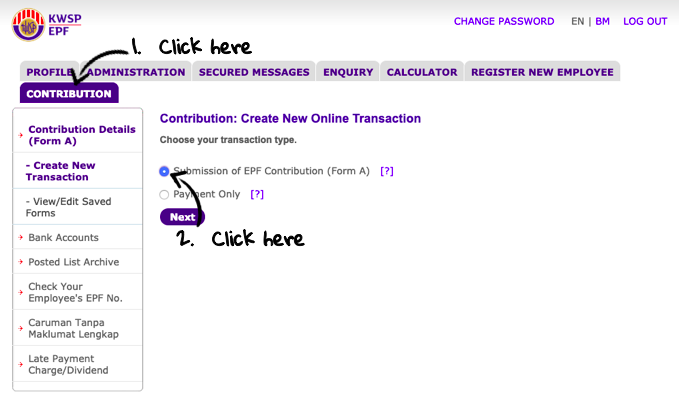

However as the word is broad enough to include payments for food clothes accommodation phone calls etc reference can be had to case law to ascertain its scope. The Employees Provident Fund EPF or commonly known as Kumpulan Wang Simpanan Pekerja KWSP is a social security institution formed according to the Laws of Malaysia Employees Provident Fund Act 1991 Act 452 which manages the compulsory savings plan and retirement planning for private sector workers in Malaysia. Monthly contributions are made up of the employees and employers share which is paid by the employer through various methods available to them.

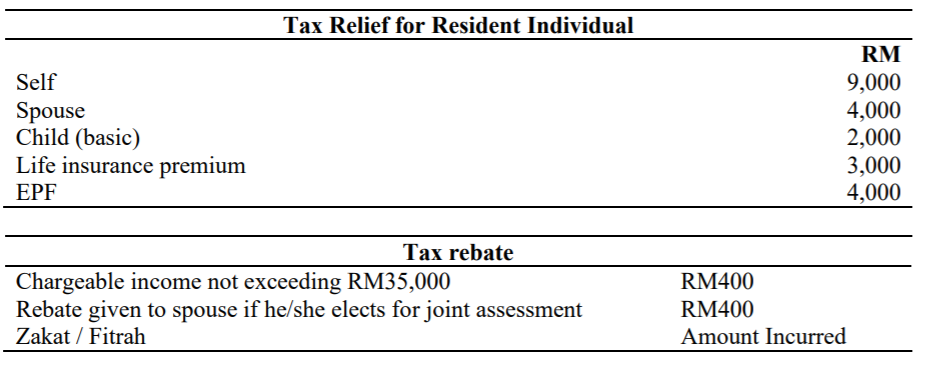

Can any one provide Include and exclude Allowances list under EPF. EPF contribution is that it qualifies for tax deduction by way of personal relief. Payments Subject to EPF Contribution.

For the month of September they receive a bonus of RM250 as. Dividends generated from EPF are also exempted from tax. By the epf and are not subject to epf deduction.

Allowance except travelling allowance is included in the definition of wages under the EPF Act. Payments Exempted From EPF Contribution.

Which Payments Are Subject To Employees Provident Fund Epf Gan And Zul Advocates Solicitors

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Monthly Tax Deduction 2 Social Security Organization 3 Employee Provident Plan Skachat Besplatno I Bez Registracii

Kwsp Epf Employees Provident Fund Guide

Wages Under Employee S Provident Funds Miscellaneous Act 1952 Sbsandco Llp

Malaysia Epf Calculator For Payroll System Smart Touch Technology

Em Han Associates Licensed Tax Agents Tax Consultant In Subang Jaya

What Payments Are Subject To Epf Donovan Ho

Remuneration That Subject To Employees Provident Fund Epf Socso Eis Hrdf Hills Cheryl

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Do You Need To Make Epf Payments For Bonuses And Cash Allowances In Malaysia Althr Blog

Prezentaciya Na Temu Malaysian Payroll Statutory Overview Malaysian Statutory Outline 02 1 Employee Provident Fund 2 Social Security Organization 3 Inland Revenue Board Of Skachat Besplatno I Bez Registracii

Contribution On Epf Socso Eis In Malaysia As An Employer Bossboleh Com

Employer Contribution Of Epf Socso And Eis In Malaysia Foundingbird

Everything You Need To Know About Running Payroll In Malaysia

Everything You Need To Know About Running Payroll In Malaysia

The Following Allowances And Tax Rates Are To Be Used Chegg Com

Faq On Epf Payment Subject To Epf Jul 21 2021 Johor Bahru Jb Malaysia Taman Molek Service Thk Management Advisory Sdn Bhd

All Payments For Wages Are Subject To Epf Deductions